property tax forgiveness pa

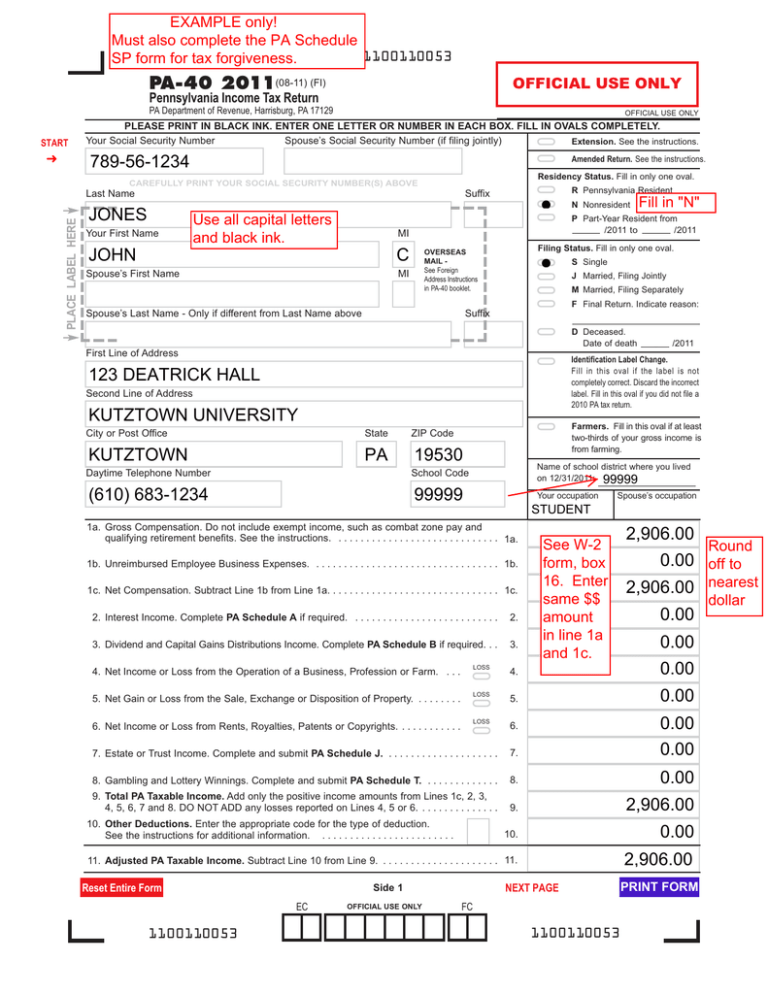

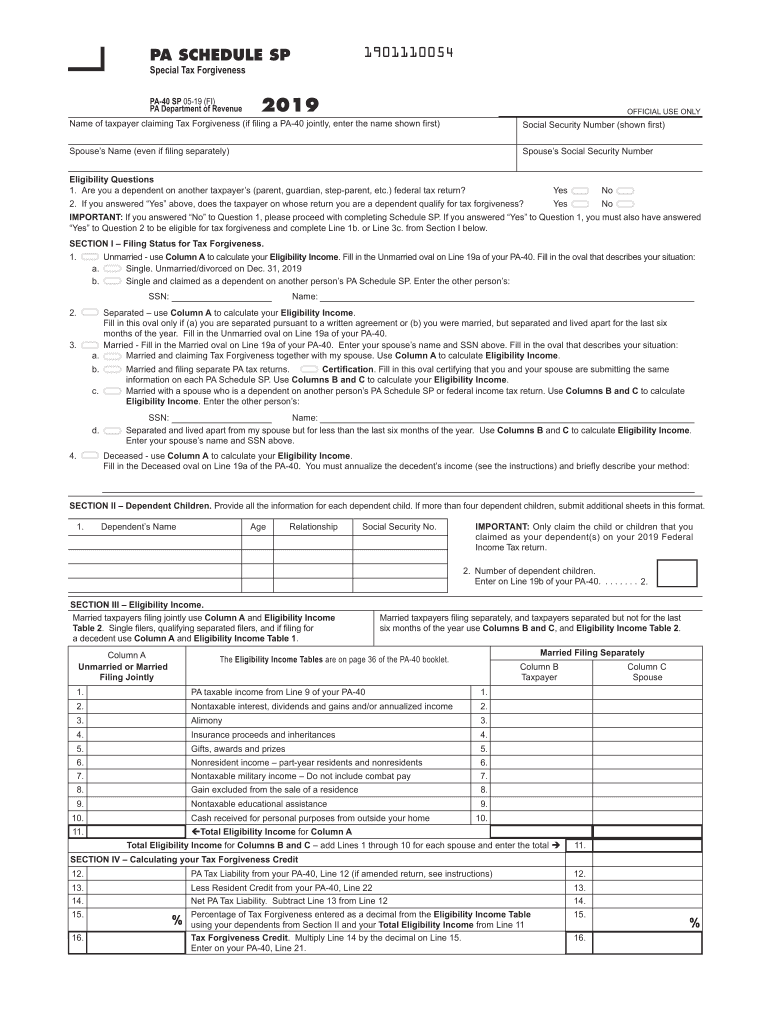

To receive tax forgiveness a taxpayer must complete the tax forgiveness schedule and file a PA-40 return. Speak With One Of Our Licensed Advisors And We Will Take On The IRS For You.

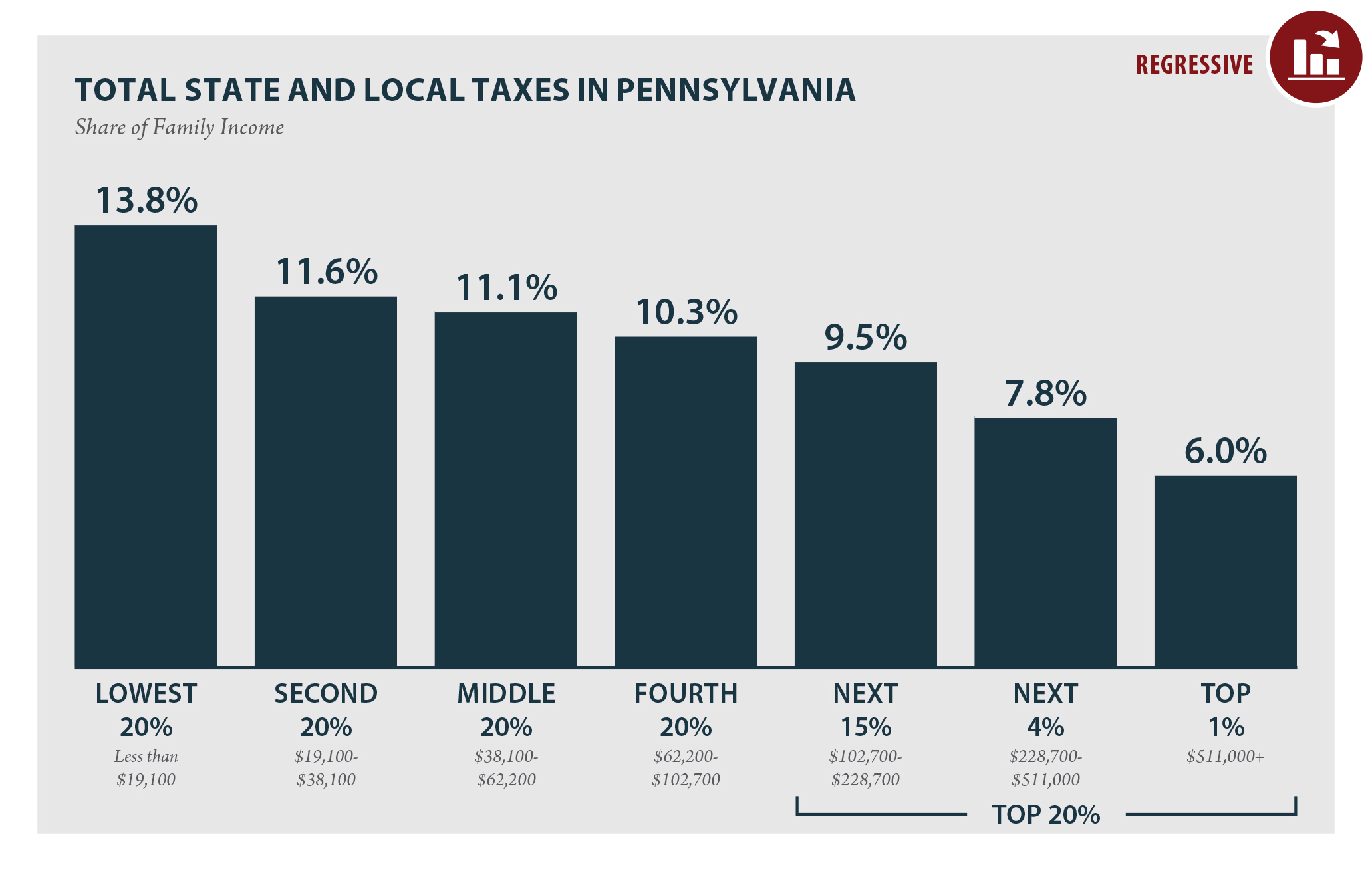

Property Tax Relief In Pennsylvania The Pennsylvania Budget And Policy Center

Pay your bill on or before the discount date in April - receive a 2 discount.

.jpg)

. Ad Solve IRS Tax Debt Problems With Top Tax Relief Companies For You To Get Relieved. Tax collecting officials including county trustees receive applications from taxpayers who. State Tax Forgiveness.

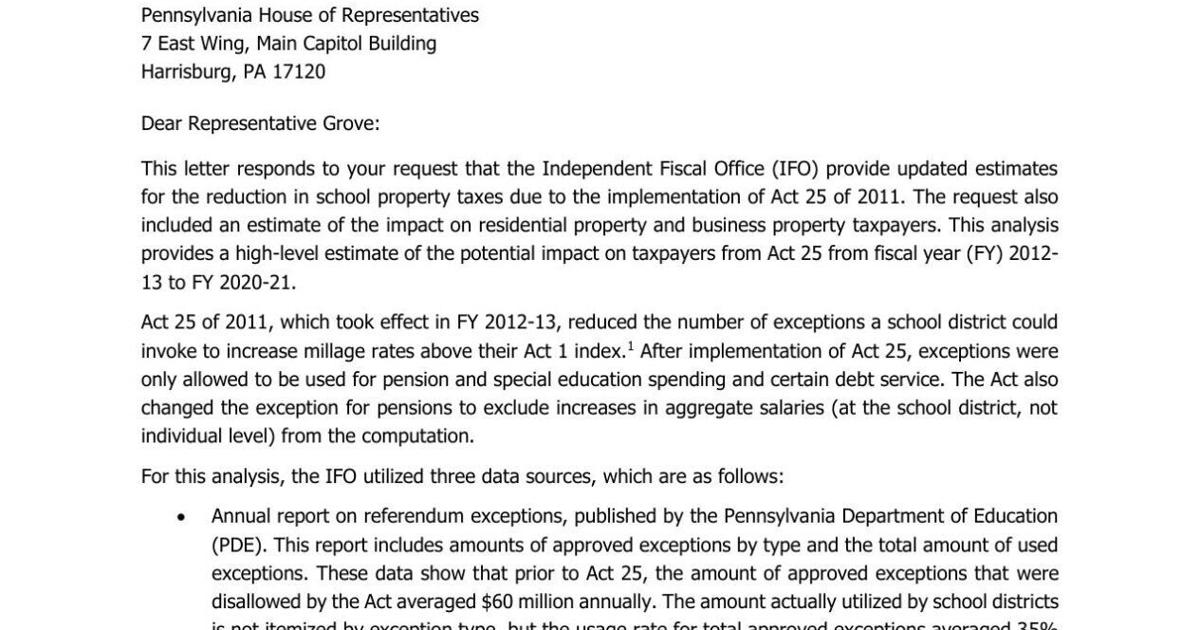

Waiver of interest surcharges and penalties on outstanding real and personal property tax debts with the Municipal Revenue Collection Center CRIM. The Taxpayer Relief Act provides for property tax reduction allocations to be distributed by the Commonwealth to each school district. If you live in PA and open a non-PA ABLE account you may miss out on important benefits.

Property Tax Penalty Forgiveness. FREE Form PA PA. Unlike many other states Pennsylvania considers your income for this exemption.

Pennsylvania is ranked number sixteen out of the fifty states in order of the. Help for unpaid and delinquent property taxes. About The Taxpayer Relief Act.

Begin Main Content Area Tax Forgiveness. On 1 March 2021 during the Fiscal Strategy Debate the Most Honourable Dr. Tax amount varies by county.

PA disabled veteran benefits include property tax exemptions. Do you qualify for 30 discount on your county taxes. The penalty for real estate taxes was forgiven through November 30 2020.

It is designed to help individuals with a low income who didnt withhold taxes throughout the year and those who are retired. These standards vary from state to state. City Real Estate Property Taxes are based on a calendar year from January 1 thru December 31 of the current year.

Tennessee state law provides for property tax relief for low-income elderly and disabled homeowners as well as disabled veteran homeowners or their surviving spouses. 135 of home value. The Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability.

Mortgage Relief Program is Giving 3708 Back to Homeowners. All Allegheny County home owners who are 60 years of age or older who have resided in and owned their own home for at least ten years and have a total gross household income that is no greater than 30000 can qualify for the Senior Citizen Property Tax Relief Program Act 77. Real property debts incurred and due for fiscal year 2012-2013 and previous tax periods as well as any debts related to the personal property tax returns through tax year 2012.

Hubert Minnis Prime Minister Minister of Finance announced the Governments immediate implementation of the Real Property Tax Forgiveness Program the Program as outlined in The Real Property Tax Amnesty Order 2021 the Order and which came into effect on 1. To issue property tax and rent rebate checks early to assist seniors and individuals with disabilities Property Tax Relief in Pennsylvania The Pennsylvania Budget and Policy Center. The median property tax in Pennsylvania is 222300 per year for a home worth the median value of 16470000.

Forgives some taxpayers of their liabilities even if they have not. This is a state program funded by appropriations authorized by the General Assembly. Wolf and his allies laid out a proposal to spend federal pandemic relief money on workers environmental programs and a one-time property tax subsidy for.

States also offer tax forgiveness based on personal income standards. The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006. Property Tax Exemptions for Veterans in Pennsylvania.

Many state and county governments allow homeowners the ability to enter into property tax installment plansSome of these programs have been recently created as a result of the housing crisis and the national recession. Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. Property tax forgiveness pa.

The level of tax forgiveness is based on the income of the taxpayer and the number of dependents the taxpayer is able to claim. Application forms for the Property TaxRent Rebate Program are now available for eligible Pennsylvanians to begin claiming rebates on Read More Harrisburg PA. The information may be provided to federal state and local agencies including your local taxing authorities in connection with review of your application.

Pay after the Face Amount due date in June - a 10 penalty is. Ad PA residents who save in PA ABLE get benefits that other states ABLE plans cant provide. For example in Pennsylvania a single person who makes less than 6500 per year may qualify to have 100 percent of their state back taxes forgiven.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Taxes paid in December will now be assessed the penalty amount and those taxes must be paid by December 31 2020. Property tax reduction will be through a homestead or farmstead exclusion.

Check Your Eligibility Today. If youre a disabled veteran with a 100 percent VA disability rating you may qualify for a complete property tax exemption. Counties in Pennsylvania collect an average of 135 of a propertys assesed fair market value as property tax per year.

A dependent is defined to be a child who can be claimed as a dependent for federal income tax purposes. Will be used to review and determine your eligibility for exemption for real property taxes under Article 8 Section 2c of the Pennsylvania Constitution and 51 PaCS. This can be done in the form of tax credits or exemptions.

Tax relief can be a big help because it can reduce or even completely negate the taxes you owe. Provides a reduction in tax liability and. Ad Find Tax Forgiveness Pa.

Many Pennsylvanians who may be eligible for a refund or reduction of their Pennsylvania personal income taxes will be receiving letters in the mail.

Are You Eligible For A Property Tax Or Rent Rebate

Pennsylvania Who Pays 6th Edition Itep

Pennsylvanians Can Now File Property Tax Rent Rebate Program Applications Online Pennsylvania Legal Aid Network

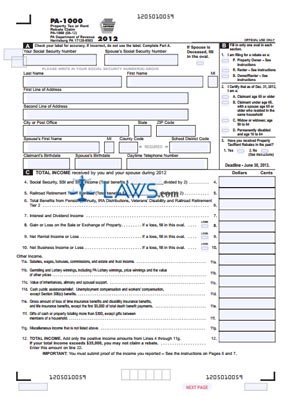

Pa Dor Pa 40 Sp 2019 2022 Fill Out Tax Template Online Us Legal Forms

Pa Budget Battle Is Covid Relief Money The Cure For Property Tax Rates Gop Says No Dems Say Yes Pittsburgh Post Gazette

Analysis Says Millions Avoided In Pa Property Taxes Impact Of Relief Depends On Perspective Local News Ncnewsonline Com

Infographic Property Tax Relief In Gov Wolf S Budget

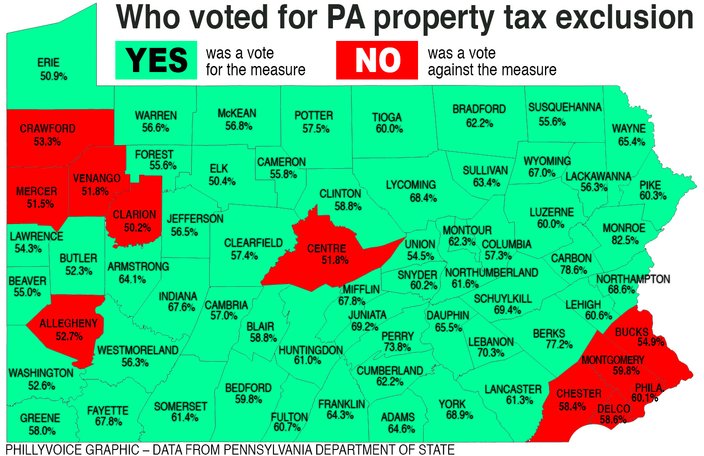

Map Here S Who Voted For Property Tax Exclusion In Pennsylvania Phillyvoice

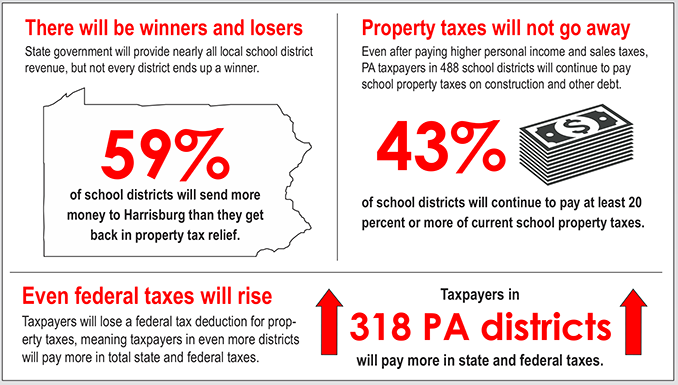

Property Tax Bill Will Cost Pa Taxpayers More

Property Tax Relief In Pennsylvania The Pennsylvania Budget And Policy Center

Free Form Pa 1000 Property Tax Or Rent Rebate Claim Free Legal Forms Laws Com

.png)